Why Carbide Prices Are Rising

The Supply Chain Forces Behind the Ongoing Increases

At Scientific Cutting Tools (SCT), we work hard to keep pricing stable. When we do make an adjustment, it is usually because something fundamental changed in the cost structure of the materials that go into your tools.

That is exactly what is happening with carbide.

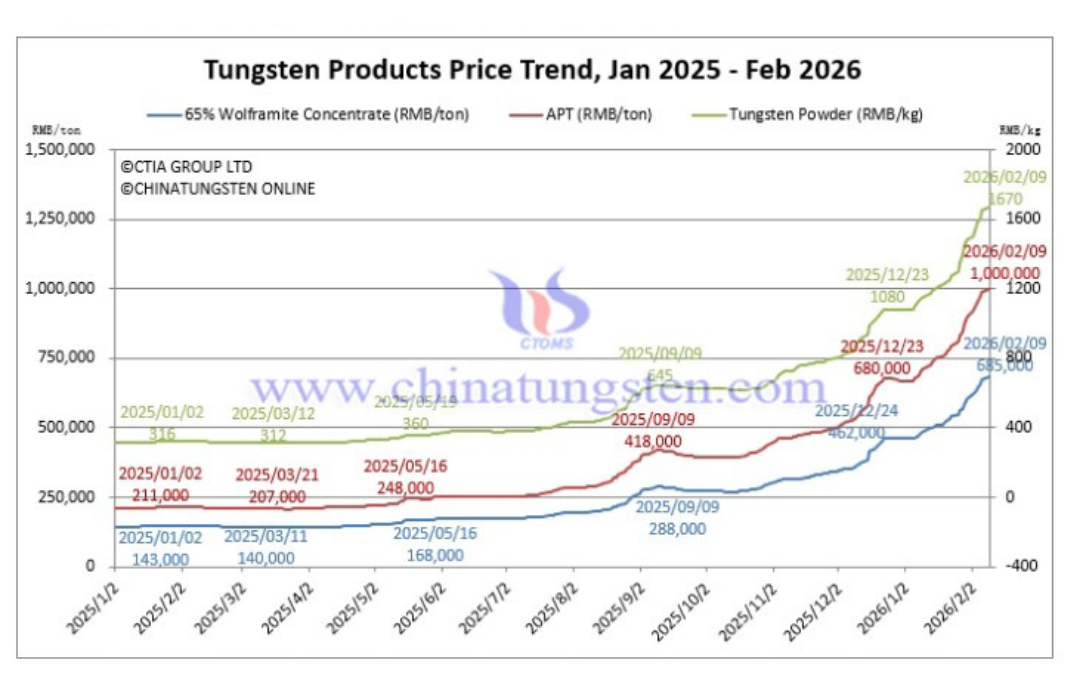

Most people hear “carbide” and think “tungsten carbide.” In the supply chain, a key upstream indicator is APT (ammonium paratungstate), a primary intermediate used to produce tungsten powders and, ultimately, tungsten carbide round rod. Round rod is what we grind to make cutting tools. In the past year, APT and tungsten pricing have moved sharply, and in ways the market has never experienced.

What follows explains what is driving the carbide spike and why we have made price increases to keep pace, while maintaining the quality and availability you expect from SCT.

APT price rise shown in red (RMB/ton) within CTIA’s “Tungsten Products Price Trend, Jan 2025 – Feb 2026.” Source: China Tungsten Industry Association (CTIA).

Carbide 101: Why APT matters to cutting tools

Tungsten has not been mined commercially in the United States since 2015, and much of the tungsten consumed in the U.S. ultimately feeds applications like cemented carbide parts for cutting and wear-resistant uses.

APT is part of the pathway from mined tungsten to the powder that becomes carbide. When APT moves, carbide powder pricing tends to follow, and carbide is a major cost component in many cutting tools. So when APT rises quickly, tool manufacturers either absorb it (temporarily) or adjust pricing to keep supply flowing and quality consistent. At SCT, we have done both, depending on the timing and severity of the market shift.

→ The 4 core reasons carbide prices are rising (and why the pressure is not going away)

1) Supply is concentrated, and new capacity is slow to add

Tungsten supply is not evenly distributed, and that matters because tungsten is the backbone of carbide. USGS data continues to show how concentrated global mine production is, with China still the dominant producer.

On top of that, the U.S. has not mined tungsten commercially since 2015 and remains highly import-reliant, so disruptions upstream become cost and availability issues downstream, even for American-made cutting tools.

2) Trade and policy changes are tightening the flow and raising landed cost

When export rules tighten, the market feels it quickly. USGS notes that China implemented new export controls on selected tungsten items in February 2025, and that pricing rose sharply throughout 2025 in that environment.

At the same time, tariff changes add cost and uncertainty to already tight supply chains. USTR has also documented Section 301 tariff increases on certain tungsten products from China (rates vary by product).

3) APT repricing is a direct upstream cost driver for carbide

APT is a major waypoint between mined tungsten and the powders used in carbide grades. When APT moves, carbide powder costs tend to follow because manufacturers are replenishing at higher replacement cost.

From early May 2025 to mid-February 2026, the move has been extreme. In Almonty’s Fastmarkets-sourced APT CIF Rotterdam table (updated weekly), APT was $390–$400 per MTU on May 2, 2025. By Feb 13, 2026, it was $1,650–$1,825 per MTU. That is roughly a 4.4× increase in the midpoint in about nine months, or +340%.

4) Demand is holding, and risk-buying amplifies the cycle

This is not a market where demand simply disappears when prices rise. AMT and USCTI have publicly noted that cutting tool makers and importers are trying to control prices, but overall prices for carbide and HSS-based products are rising, even while unit volumes remain normal.

When supply is tight and customers still need product, buying gets more proactive, inventory gets pulled forward, and that behavior can keep upward pressure in place longer than anyone wants.

Jack Burley, chairman of AMT’s Cutting Tool Product Group and president of Big Daishowa

“Cutting tool manufacturers and importers are doing their best to control prices, but it has become more apparent that the overall prices for carbide and HSS-based products are on the rise.”

Practical ways to offset cost increases of carbide tooling on the shop floor

A price increase is never “good news,” so here are realistic moves that often reduce tooling spend per part even when costs rise:

Standardize and reduce variation

Stable toolholding, coolant delivery, and runout control often extend life more than a small tweak in feeds and speeds.Match the tool to the cut

Using the right geometry and grade for the material reduces premature wear. This is one of the fastest levers.Protect the edge

Edge prep, coating selection, and correct application strategy are where tool life is won or lost, especially in abrasive or heat-generating cuts. This is one of the main drivers of our Tech Trifecta — we want to help you mitigate costs by increasing the life of your tool.Plan purchases around reality, not hope

If you have predictable production, align blanket orders or stocking plans to avoid buying at the worst moment.

Customer impact: what the bottom line is for our distributors and end users

Taken together, the factors outlined above are tightening supply, raising landed cost, and pushing APT-driven replacement cost higher across the carbide market. That is why SCT has implemented price increases on carbide-driven products where those inputs materially affect cost. We have also absorbed portions of the increase when we could, but the pace and scale of change have required updates to keep supply reliable and quality consistent for our distributors and end users.

SCT remains committed to transparent communication and stable supply, and our most recent adjustment reflects cost pressures the industry is feeling broadly. If you would like help selecting the right tool for your material, application, or production goal, our team can recommend options that maximize consistency and tool life in today’s market. For a deeper dive, listen to our full-length podcast on the topic using the button below.